How to Save for Christmas All Year: A Simple Plan for Couples

Hi folks, Jade here!

I’m not usually someone who plans far in advance for big purchases. I’m more of the “Oh snap, Christmas is in a month. I should probably start thinking about gifts for my wife and family” type. I really prefer to buy gifts freely without paying attention to spending.

But it’s inevitable that every year, by the time Christmas is over, I’m shocked at how little money we have left in our joint account. The sudden regret - then being angry at myself for not planning ahead gets really exhausting. After all, bills still come due on Jan 1st, and it sucks having to explain to Leah that I accidentally overdrafted our account - again.

This was sort of the yearly routine in the early years of our marriage, and we never really figured it out until a friend showed me the neobank she used that came with its own budgeting software (Simple Bank).

It basically allowed her to stuff money into digital envelopes for whatever she wanted. Eventually, after a few automated deposits into those envelopes, you’d have a pretty nice sum of cash saved up. You could even trigger that money to deposit right away on your pay day, so the money was out of sight and out of mind before you even knew it was there.

Leah and I signed up immediately. We decided to set up a Yours, Mine & Ours solution with three checking accounts: one for myself, one for Leah, and one we shared together.

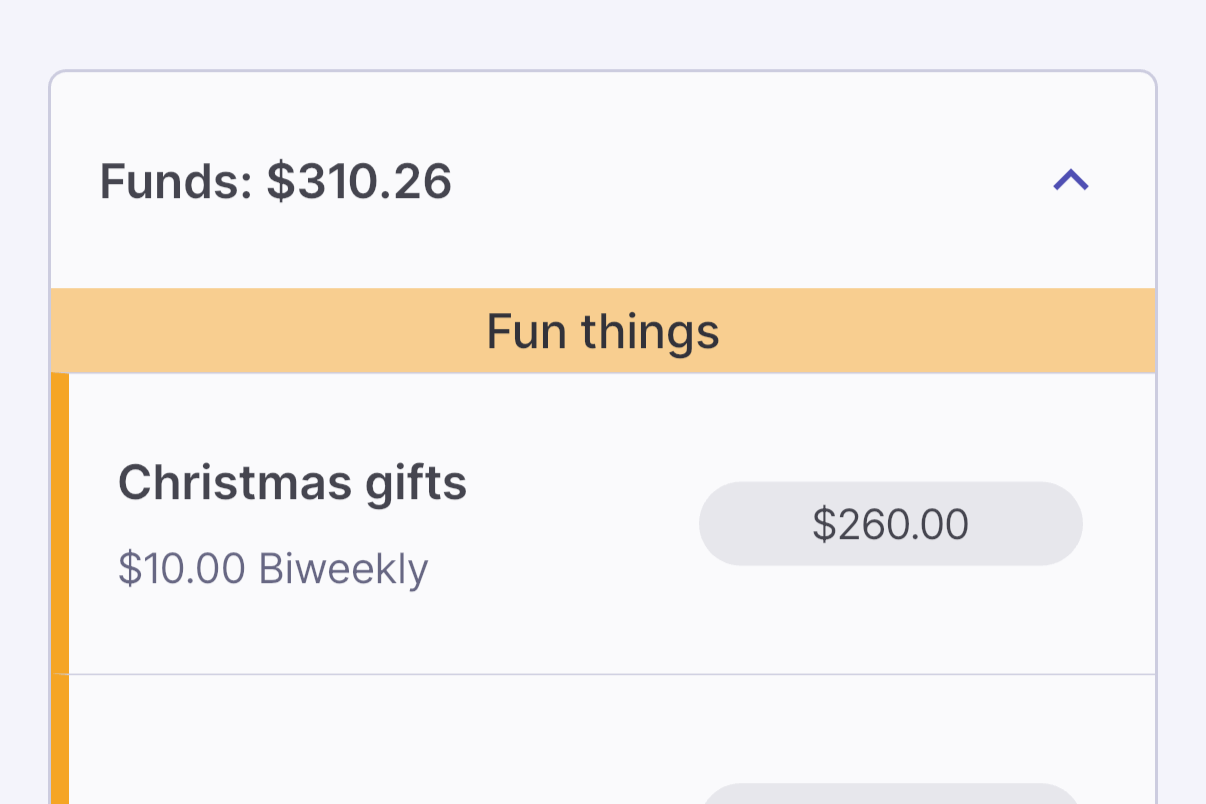

And of course - the first thing I did was set up a bucket specifically for Christmas gifts.

Every Jan 1st, I would stash away $20 from each paycheck - and come Black Friday I’d have almost $500 set aside! Managing our budget was super easy using this solution, and overdrafting was a complete non-issue.

Unfortunately for us though, Simple closed its doors in 2021. This was what eventually led to us creating our own solution inspired by the same envelope budgeting premise (with a Yours, Mine, & Ours twist).

We’re using Halfsies here, but you can use another app (or even just cash and envelopes) to set a little bit aside every paycheck:

Make an envelope: Either digital or physical, you need somewhere you can stash money into. I like to set this up under my personal budget, so I can keep it hidden and surprise Leah.

Decide on a funding amount: Is there a target amount you want to shoot for ($100 per family member)? Or are you looking to just set aside $20 every paycheck? I find just putting whatever I can afford away each paycheck the easiest, but you might have a more specific goal in mind.

Set your due date - or don’t: I just like setting aside money and seeing how much I have by Black Friday. My wife is a planner though, so she likes to have a specific amount saved up by November 1st.

Fund your envelope: How much do you want to contribute? Pick what sounds doable to you. Or if you have a specific goal you’re trying to reach: figure out how many pay dates fall between now and your due date. Then divide your target amount by your pay date amount. That’s what you’re going to put into your envelope every paycheck. Doing this for all of your expenses can be a lot to juggle though, so I just let our app calculate all of this for me.

Forget about it (if digital): If you’re using a service like Halfsies, just sit back and wait for the holidays! Your envelope fundings trigger with automatically with every paycheck deposit - before you can even miss them. If using manual envelopes, you’ll have to stuff them with cash yourself every paycheck. But trust me, having the money waiting for you at the end of the year is worth it!

Just $10 per paycheck throughout the year ensured that I had over $250 set aside by the time Christmas rolled around.

And here’s how much you can have saved if you start right now:

| $10 biweekly | $20 biweekly | $40 biweekly | |

|---|---|---|---|

| By March | $60 | $120 | $240 |

| By June | $120 | $240 | $480 |

| By Black Friday | $240 | $480 | $960 |

| By Christmas | $260 | $520 | $1040 |

This applies to the rest of the year as well. Whether it’s Christmas in December or a birthday in June - you can have $400 set aside in just 5 months at $40 per paycheck. That’s a Nintendo Switch 2 for someone special, and it didn’t even take you half the year to save up for it.

That is to say - setting aside a little from every paycheck throughout the year can save you a lot of headache (and overdraft) fees down the road.

This is something I’m trying to keep in mind as we move into New Years and start thinking about our resolutions for 2026. We’re getting our funds set up for car repairs, birthdays, emergencies, etc. And with a new baby on the way I’m more motivated than ever to throw him a wonderful first Christmas, with lots of warmth, love, and two very stress-free mommies.

Well…money-wise at least.